At Florida Community Loan Fund, we are driven by a single, unwavering core purpose: to maximize opportunities for people and places outside of the economic mainstream. This purpose guides every decision we make, every investment we commit, and every relationship we cultivate.

FCLF understands that capital is a powerful tool for positive change. Through our core programs – community development financing and New Markets Tax Credit − we are providing capital that flows throughout the State of Florida. This flexible capital allows our borrowing partners to grow their impact, reach more individuals, and amplify their missions, thus extending the reach of existing resources and empowering organizations to unlock their full potential.

With the support of our investors and partners, FCLF achieved significant milestones in 2023, including:

- Record-setting loan production: $82 million in financing, with 33% dedicated to affordable and supportive housing and 67% supporting community facilities.

- Continued investment in distressed communities: $40 million in New Markets Tax Credit allocation received from the CDFI Fund and three projects funded through the program.

- Promoting diversity: 86% of our CDF and NMTC financing was invested in communities of color.

“... to maximize opportunities for people and places outside the economic mainstream.”

CEO

Board Chair, 2023

ATTRACTING NEW CAPITAL TO FLORIDA

Escalating housing costs have a profound impact on low-income households in Florida, forcing families to choose between rent and other necessities. Over the years, developing financially-viable affordable housing has become increasingly challenging for our borrowers to accomplish due to rising costs.

As a leading provider of flexible capital, FCLF has created solutions and provided tools to support low-income communities and increase the production and availability of affordable housing. One tool that can be a powerful solution to creating more affordable rental housing is the Capital Magnet Fund (CMF).

Administered by the U.S. Dept. of Treasury’s CDFI Fund, CMF awards competitive grants to CDFIs and nonprofit housing organizations to spur investment in affordable housing across the country.

In fiscal 2023, Florida Community Loan Fund was awarded a $10 million CMF grant, thus securing a new tool to help high-impact projects succeed.

Capital Magnet Fund Projects Financed to Date

Colonnade Park developed by Green Mills Group • Inveness • 106 affordable housing units in Inverness • $18.1 million total project cost

- Mitch Rosenstein, Principal

Saint Stephen’s Way, Melbourne

FCLF IMPACT

• $8.25 million FCLF financing

• 40 supportive housing units + community center

• majority minority census tract

FCLF IMPACT

• $510,000 FCLF financing

• 7 affordable rental housing units

• minority- and woman-owned business

• majority minority census tract

DELIVERING SOCIAL SERVICES IN FLORIDA

FCLF IMPACT

• $63.5 million total project budget

• $12 million FCLF NMTC allocation

• $9.5 million FCLF community development financing

• construction of new 215,000 sq-ft facility

• estimated reach 716,000 annually • 335 jobs created or retained

FCLF IMPACT

• $32.1 million total project budget

• $19 million FCLF NMTC allocation

• construction of new 71,280 sq-ft facility

• estimted reach 13, 400 annually

• 158 jobs created or retained

CELEBRATING SUCCESS STORIES

FCLF IMPACT

• $1.25 million FCLF financing

• construction line of credit

• 29 new single-family affordable homes for ownership

FCLF IMPACT

• $13.3 million FCLF financing

• revolving credit line to purchase and renovate homes

• 75 homes to date for sale or rent

OUR IMPACT

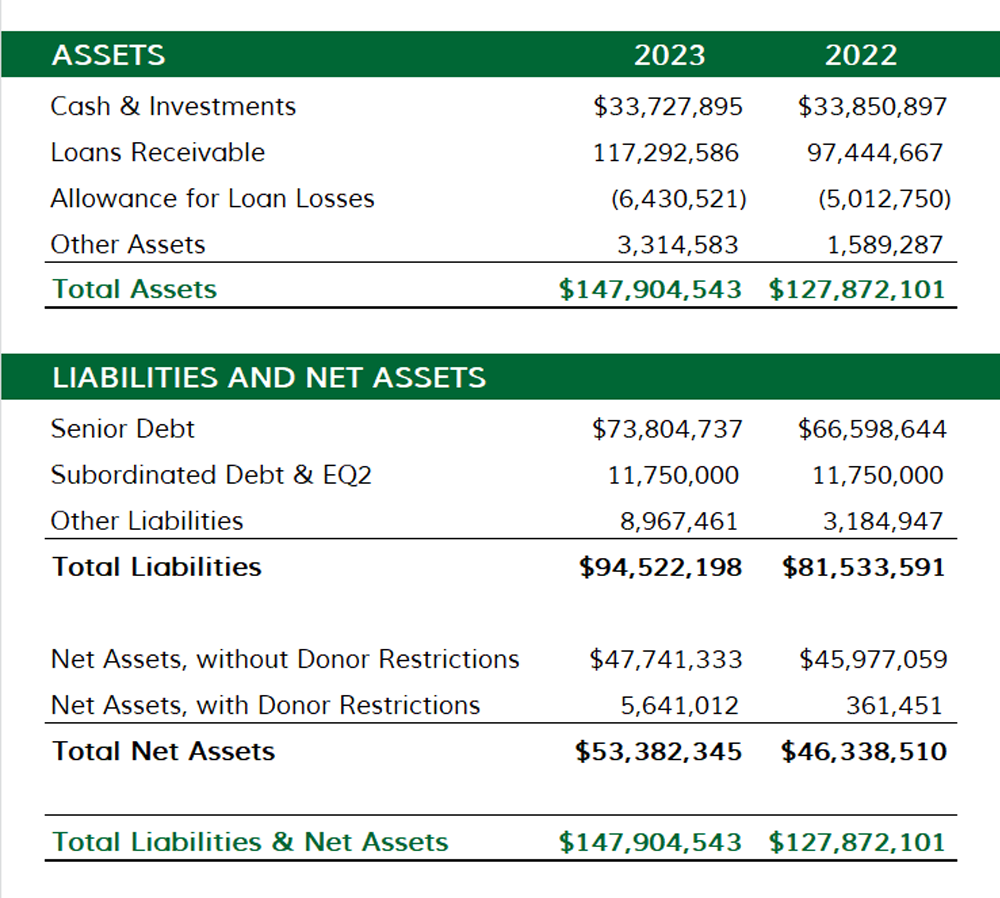

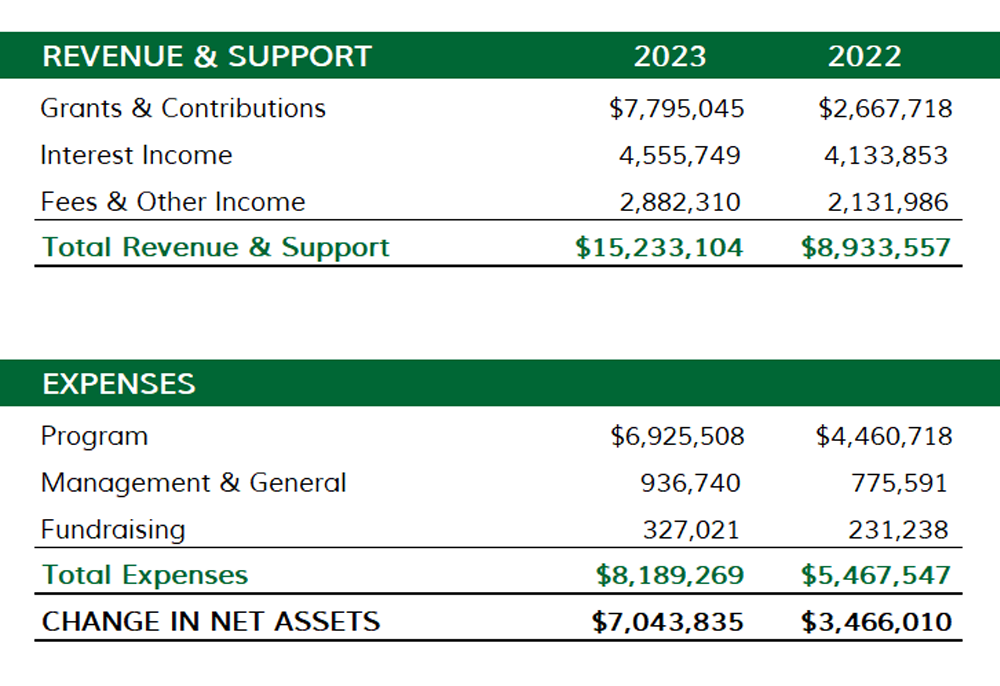

FINANCIAL RESULTS 2023

Statement of Financial Position

Statement of Activities

Loan Portfolio by Sector

INVESTORS AND SUPPORTERS

Religious Organizations • Adrian Dominicans • Archdiocese of Miami • Diocese of Palm Beach • Diocese of Venice • Mercy Partnership Foundation • Oblates of St. Francis de Sales • Religious Communities Impact Fund • Religious of the Sacred Heart of Mary, In Memory of Sr. Mary Heyser • School Sisters of Notre Dame (Maryland) • Sinsinawa Dominican Sisters • Sisters of Charity of Nazareth • Sisters of Charity of St. Elizabeth • Sisters of Providence • Sisters of St. Francis of Philadelphia • Sisters of the Blessed Sacrament • Sisters of the Holy Names of Jesus and Mary • Sisters of the Sacred Heart of Mary • Trinity Health • Union for Reform Judaism

Financial Institutions and Corporations • Amerant • Banesco USA • Bank of America • BankUnited • BBVA Compass • BMO Harris Bank • City National Bank of Florida • Comerica Bank • FineMark National Bank & Trust • Fifth Third Bank • First Citizens Bank • First Horizon Bank • First Republic Bank• Florida Capital Bank • HSBC Bank USA, NA • Northern Trust • PNC Bank • Raymond James Bank • Regions Bank • Santander Bank • Seaside National Bank & Trust • SouthState Bank • Synovus Bank • TD Bank • Third Federal Savings & Loan • TIAA Bank • Truist Bank • Trustco Bank • United Community Bank • US Bancorp Community Development Corporation • US Bank, NA • Valley Bank • Wells Fargo Bank

Foundations • Bank of America Foundation • Erich and Hannah Sachs Foundation • The Father's Table Foundation • Health Foundation of South Florida • JPMorgan Chase Foundation • PNC Foundation • TD Charitable Foundation • Wells Fargo Foundation

Nonprofit Organizations • Good to Grow Fund • Miami Homes for All • Opportunity Finance Network

Government Agencies • Community Development Financial Institution (CDFI) Fund of the U.S. Department of the Treasury • Florida Department of Agriculture and Consumer Services, Division of Food, Nutrition and Wellness

Individuals • G. Dawson • M. & V. Simmons

FCLF BOARD OF DIRECTORS

Claire Raley, Chair. Senior VP, CRA/Community Development Officer, BankUnited, N.A.

Tina Brown, Vice Chair. CEO, OYC Miami

Germaine Smith-Baugh, 2nd Vice Chair. Preisdent & CEO, Urban League of Broward County

Judith Rimbey, OP, Treasurer. Business Office Assistant, Cardinal Newman High School

Victor Rivera, Secretary. SVP, Senior Relationship Manager, Business Banking, Bank of America

Ana Castilla, Vice President, Community Development Manager, TD Bank

Ernest Coney, Jr., President & CEO, CDC of Tampa

Alecia Dillon, CFO, Health Foundation of South Florida

Jack Humburg, Chief Operating Officer, Boley Centers, Inc.

Annie Neasman, President and CEO, Jessie Trice Community Health System

David R. Punzak, Esquire

John Talmage, Director, Lee County Economic Development Office